At the dawn of the 21st century, businesses and customers couldn’t always establish the legal identity of parent companies because there wasn’t a universal code identifying each legal entity. The lack of such an identifier led to many frauds that culminated in the 2008 market crash.

When the dust settled, G20 introduced the concept of Legal Entity Identifier (LEI) to address once and for all this glaring issue.

In this article, we’ll discuss LEI codes, including what is an LEI number (Legal Entity Identifier), LEI history, benefits, applications, and how to get an LEI code for your company.

Table of Contents

- What Is a Legal Entity Identifier (LEI) Code?

- Who Needs an LEI Number?

- Where Do LEI Numbers Come From?

- How Does an LEI Code Work?

- What Is an LEI Code Example?

- LEI Code Benefits

- How to Obtain a Legal Entity Identifier?

What Is a LEI Number?

The LEI Number, or Legal Entity Identifier, is a unique 20-character code that identifies an organization engaging in financial transactions. Defined by the ISO 17442 standard and sanctioned by the world’s major economies (G20), LEIs facilitate regulatory compliance and prove companies’ legitimacy globally.

What Is a Legal Entity Identifier Used For?

Each LEI contains information about an entity’s ownership structure and thus answers the critical questions of ‘who is who’ and ‘who owns whom’, connecting parent and children organizations most transparently.

The publicly available LEI data pool ensures safe and predictable transactions and is available to any interested party, conveniently and free of charge.

What Data Does an LEI Code Include?

An LEI code includes the following data:

- Legal entity or fund’s manager official name

- Registry name and registry number

- Company’s legal form

- ISO country code

- Headquarters’ address

- Date when the LEI was first issued

- Date when the LEI expires

- Date of the last change of information

LEI Code History

LEI codes had been on the private sector’s wishlist long before their implementation. But, as it’s often the case, only a global financial crisis urged the world’s largest economies to develop a concrete solution.

Nothing exposed the need for a legal entity identifier more than the Lehman Brothers’ collapse in 2008. When the global financial service firm went bankrupt and sent shockwaves across the world, regulators couldn’t quickly identify the vast network of market participants connected to Lehman.

Each country had different code systems to recognize the counterpart corporation of financial transactions. Moreover, it was impossible to pinpoint the transaction details of individual corporations and the counterpart of financial transactions.

In the aftermath of the market collapse, the leaders of the world’s largest economies via the G20 and Financial Stability Board (FSB), agreed to create a global solution that would legally identify organizations engaged in financial transactions.

In March 2011, the International Organization for Standardization (ISO) created a dedicated working group to establish an LEI standard, developed a draft specification (ISO 17442), and selected a registration authority to oversee the assignment.

The first LEIs were issued in December 2012. As of February 2022, the number of LEIs surpasses the 2 million mark.

Who Needs an LEI Number?

With new tight regulations governing the financial markets, the number of jurisdictions and industries requiring LEI numbers is on a steady rise. Any legal entity performing financial transactions may obtain an LEI code and get indexed on the official LEI register. From the banking and insurance sectors to the private industries, companies use LEIs to increase transparency and boost credibility.

If your company is in one of the following categories (but not limited to) you’re required by law to register an LEI code.

- Investment companies and lenders

- Bankers

- Brokers

- Fund managers

- Traders

- Institutional Investors

- Exchange officials

- Financial intermediaries

Companies that may still request an LEI even if it’s not required by law:

- Association and branches

- Government bodies

- Charities

- Limited Companies

- Sole traders

- Business Validation SSL certificate owners

- Extended Validation SSL certificate owners

Where Do LEI Numbers Come From?

Behind each LEI code is a rigorous compliance process, monitored by a global regulatory community, private sector firms, and industry associations. The international entity governing the assignment of codes to the Global LEI System (GLEIS) is the Regulatory Oversight Committee (ROC).

ROC and the private sector established the Global LEI Foundation (GLEIF), an organization that certifies Local Operating Units (LOU) to assign LEI codes in different jurisdictions. The foundation is led by a 16-member board of directors, all from the private industry.

Local Operating Units use the regional business knowledge and practices to approve LEI numbers in their jurisdiction, streamlining the LEIs issuance and ensuring the best management protocols.

How Does an LEI Code Work?

An LEI code has many similarities to a barcode or a digital passport. Its purpose is to identify and authenticate participants in highly-regulated industries. LEis have replaced outdated validation methods such as KYS (Know Your Customer) standards, which take longer and are vulnerable to forgery.

The two core aspects of LEIs are the 20-digit alphanumeric code attributed to an entity and the public LEI directory that records all LEI registrants.

Banks, financial regulators, and Certificate Authorities are some sectors that actively use LEI codes to authenticate clients. Since an LEI already contains the entity’s legal status, the verification process is quick, convenient, and secure.

By being a global initiative, LEI codes incorporate the latest technological and safety advancements in the financial segments and deliver efficient identification of all parties.

What Is an LEI Code Example?

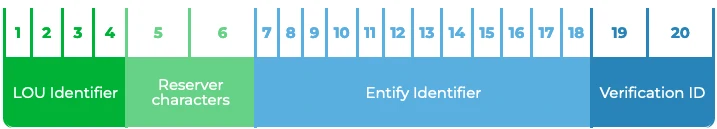

The 20-character code includes all the necessary information for easy identification:

- The first four character prefixes are assigned uniquely to each LOU (Legal Operating Unit).

- The following two characters are set to zero and retained for future use.

- The following twelve characters are the entity-specific part of the code generated and assigned by LOUs according to transparent allocation policies.

- Finally, the last two digits represent the verification ID described in ISO 17422.

LEI Code Benefits

It didn’t take long for LEIs to become the primary worldwide business identifier. Local and offshore companies use LEI codes to comply with financial regulations and operate efficiently in challenging environments.

LEI benefits go beyond their uniqueness and singularity. According to McKinsey, a global management consulting firm, the LEI system can save the banking industry between two to four billion USD annually in Know Your Customer (KYC) checks.

Here are more reasons why companies should get a Legal Entity Identifier:

- Trust in the Company’s Identity. Trust is the foundation of any successful transaction. In a global marketplace, performing due diligence before an acquisition or investment is a crucial step toward a positive undertaking.

An LEI code simplifies the process by proving the entities are genuine and operate in good faith. Before obtaining an LEI, an entity’s status as an active company is verified using official local company registries. - The LEI is Standardized Worldwide. Whether you’re from the US, EU, or an offshore jurisdiction such as the Cayman Islands, the LEI provides identical company data regardless of jurisdiction or industry. There’s no need to browse through national registries and waste time on the KYC process when the entire lei data pool is available on Global LEI Index.

Moreover, an LEI code allows you to obtain an LEI Certificate, which is downloadable, printable proof of your status as a registered legal entity. - Global Compliance. With an LEI code, you can operate in hundreds of jurisdictions and do business internationally. The largest economic areas such as the US, the UK, and the EU require an LEI for reporting purposes.

Over 120 regulations mandate LEIs both globally and locally. Among them are MiFID II, MiFIR, EMIR, FICOD, Dodd-Frank Act, and many others. No LEI means no trade. - SSL Validation Speed-Up. SSL certificates are now mandatory for all websites regardless of type, size, and industry. But Business Validation and Extended Validation certificates require paperwork, and the authentication could drag on if the Certificate Authority can’t corroborate the company’s details with the official data in a public registry.

With an LEI code, the entire process speeds up because the CA can check the Global LEI index and quickly find the relevant data about your business. - Lifetime Authenticity. The LEI system is not affected by any changes that occur in the lifetime of an entity. Even if a given entity is dissolved through closure or merger or incorporated by another entity, its original identifier remains valid, allowing the recovery of reference data relating to the time of the entity’s activity.

- Accessibility Beyond Human Use. Not only humans can use LEI records but applications as well. The LEI database is accessible via web, API, or full dataset download.

LEI codes offer multilingual support for names and addresses and are included in QR codes, bar codes, digital signatures, e-documents, site seals, and more. Human and machine-readable XBRL digital signatures utilize LEIs for financial statements and annual reports integrity.

Now that we’ve listed the main benefits of LEI codes, let’s see which entities can’t operate without an LEI, and which companies can still apply for an LEI even if it’s not mandatory yet.

How to Obtain a Legal Entity Identifier?

LEI codes are easily accessible to thousands of entities across different jurisdictions. Obtaining a legal entity identifier is quick and easy. There’s no need for extensive paperwork, and in most cases, it takes just a few minutes to fill in the form of your LEI provider.

How to Apply for a Legal Entity Identifier Number?

At SSL Dragon, the LEI application process is automated. We offer affordable LEI plans and multi-year discounts along with excellent support.

First, perform an LEI search before placing a new order, as only one LEI can be allocated to an entity.

After you select your billing cycle, proceed to checkout and enter your details and billing information.

SSL Dragon is one of the most trusted LEI registration agents and will deliver your LEI in 1 to 36 hours, depending on your jurisdiction.

What Are the Legal Entity Identifier Requirements?

Several documents can be accepted as official registry data. The documents should confirm the legally registered entity name, current address, and name of primary stakeholders (e.g., Director, CEO).

An LEI application must provide the registration address (found on the entity formation documents) and the headquarters address (where the entity does business). These addresses can be identical, but both must be included to register an LEI.

Here’s the list of data and documents needed to get an LEI:

- Legal name.

- Registered address.

- Address of headquarters.

- Registration number and governing authority.

- Entity type.

- Parent company relationship information.

Final Words

The introduction of the LEI code was long overdue, but as the saying goes, it’s better late than never. After the 2008 market crash, the global economy as a whole and the financial sector, in particular, have learned some harsh lessons. This article has tried to answer what is a legal entity identifier and why it’s an essential element of modern-day financial and digital transactions.

Without a global legal entity identifier, financial crimes ran rampant until the entire system collapsed. Today, the world economy is healthier and safer thanks to the coordinated effort of public regulators and private industry.

The LEI code is a simple solution to a complex problem. It brings trust, security, and predictability to organizations dealing with financial transactions. Endorsed by hundreds of regulators, the LEI’s ultimate aim is to better manage financial risks. If your company doesn’t have an LEI code, now is the perfect time for an LEI code registration.

Frequently Asked Questions

Regulated financial institutions and other regulated industries must register an LEI to participate in specific financial transactions. However, any legal entity, regulated or not, can obtain an LEI code and enjoy its benefits.

Copy Link

US legal entities such as unions, banks, funds, and organizations dealing with financial transactions, stocks, bonds, and other securities are required to obtain an LEI number.

Copy Link

At SSL Dragon, LEI plans start at just $59 per year, but you can save up to 17% if you buy an LEI code for multiple years.

Copy Link

An LEI is valid for one year and must be renewed annually to retain the “ISSUED” status, which confirms the entity is operating legally as of the last verification.

Copy Link

Estimated LEI registration time varies by country. Applicants from Australia, the US, the UK, and European Union should receive the LEI code less than an hour after applying. For other countries, LEI processing may take between 1 and 36 hours.

Copy Link

An LEI is a unique 20-character alphanumeric string. Here’s how a typical LEI code looks: 439900T8BM49AURSDO27

Copy Link

The quickest and most accurate way to find your LEI number is via the official GLEIF LEI checker. Enter your legal company name to see your LEI code.

Copy Link

LEI issuers are called Local Operating Units (LOUs). These organizations register and renew LEI codes and act as the main link for legal entities wishing to obtain an LEI. Only LOUs accredited by the Global Legal Entity Identifier Foundation (GLEIF) can issue LEIs.

Copy Link

An individual can not obtain an LEI because the identifier establishes the trustworthiness of organizations involved in financial markets and transactions.

Copy Link

Save 10% on SSL Certificates when ordering today!

Fast issuance, strong encryption, 99.99% browser trust, dedicated support, and 25-day money-back guarantee. Coupon code: SAVE10